How to Calculate After Tax Real Rate of Interest: A Clear Guide

Calculating the after-tax real rate of interest is an essential financial skill that can help individuals make informed investment decisions. The after-tax real rate of interest is the actual return on an investment after accounting for inflation and taxes. It is the rate of return that an investor earns on their investment in real terms, meaning the return on investment adjusted for inflation.

To calculate the after-tax real rate of interest, investors need to consider several factors, including the nominal interest rate, the inflation rate, and the tax rate. The nominal interest rate is the rate at which an investment grows before taxes and inflation. The inflation rate is the rate at which the general level of prices for goods and services is rising. The tax rate is the percentage of an investor's income that is paid in taxes. When these factors are taken into account, investors can calculate the after-tax real rate of interest, which gives them a more accurate picture of their investment's actual return.

Understanding Interest Rates

Interest rates are a fundamental concept in finance. They represent the cost of borrowing or the reward for saving money. The interest rate is expressed as a percentage of the amount borrowed or saved and is usually calculated on an annual basis. Understanding interest rates is crucial for making informed financial decisions.

Nominal vs. Real Interest Rates

Nominal interest rates are the rates that are quoted by banks and other financial institutions. These rates do not take into account the impact of inflation. Real interest rates, on the other hand, do take inflation into account. The real interest rate is the nominal interest rate minus the inflation rate.

For example, if the nominal interest rate is 5% and the inflation rate is 2%, the real interest rate is 3%. This means that the purchasing power of the money invested will increase by 3% after accounting for inflation.

Inflation and Its Impact on Interest Rates

Inflation is the rate at which the general level of prices for goods and services is rising. Inflation erodes the value of money over time. As a result, inflation has a significant impact on interest rates.

When inflation is high, lenders demand a higher nominal interest rate to compensate for the loss of purchasing power caused by inflation. On the other hand, borrowers are willing to pay a higher nominal interest rate when inflation is low because they can repay the loan with cheaper dollars in the future.

In conclusion, understanding nominal and real interest rates and the impact of inflation on interest rates is crucial for making informed financial decisions. By taking inflation into account, investors can calculate the after-tax real rate of return, which provides a more accurate measure of the true value of their investments over time.

The Concept of After-Tax Interest Rates

After-tax real rate of interest is an essential concept in finance. It is the actual financial benefit of an investment after accounting for inflation and taxes. The after-tax real rate of interest is the rate of return on an investment after adjusting for taxes and inflation. This rate is an important metric for investors to consider when evaluating investment opportunities.

Tax on Investment Income

Investment income is subject to taxation. The tax rate on investment income varies depending on the type of investment and the investor's tax bracket. For example, interest income from bonds is taxed at the investor's marginal tax rate, while long-term capital gains from stocks are taxed at a lower rate.

When calculating the after-tax real rate of interest, it is essential to consider the tax implications of the investment. The after-tax return is the return on the investment after taxes have been deducted. The after-tax return is calculated by subtracting the tax rate from the gross return.

Effective Tax Rates

The effective tax rate is the average rate at which an investor's income is taxed. It takes into account all the different types of taxes that an investor may be subject to, including federal, state, and local taxes.

When calculating the after-tax real rate of interest, it is essential to consider the investor's effective tax rate. The effective tax rate can significantly impact the after-tax return on an investment. Investors with a higher effective tax rate will have a lower after-tax return on their investment than investors with a lower effective tax rate.

In summary, understanding the concept of after-tax real rate of interest is important for investors. It is essential to consider the tax implications of an investment when calculating the after-tax return. The effective tax rate is an important metric to consider when evaluating investment opportunities. By taking into account taxes and inflation, investors can make more informed investment decisions.

Calculating Real Rate of Interest

To calculate the after-tax real rate of interest, one must consider inflation and taxes. The following subsections explain how to calculate the real rate of interest.

The Fisher Equation

The Fisher equation is used to calculate the nominal rate of interest, which is the rate before adjusting for inflation. The formula is as follows:

Nominal rate of interest = Real rate of interest + Inflation rate

To calculate the real rate of interest, one must rearrange the equation as follows:

Real rate of interest = Nominal rate of interest - Inflation rate

For example, if the nominal rate of interest is 8% and the inflation rate is 3%, the real rate of interest is 5%.

Adjusting for Inflation

To calculate the after-tax real rate of interest, one must adjust for taxes and inflation. The formula is as follows:

After-tax real rate of interest = [(1 + After-tax nominal rate of interest) / (1 + Inflation rate)] - 1

To calculate the after-tax nominal rate of interest, one must first calculate the after-tax rate of return and then adjust for inflation. The formula is as follows:

After-tax rate of return = Pre-tax rate of return x (1 - Tax rate)

For example, if the pre-tax rate of return is 10% and the tax rate is 20%, the after-tax rate of return is 8%.

To adjust for inflation, one must use the inflation rate in the formula for the after-tax real rate of interest.

In conclusion, calculating the after-tax real rate of interest requires consideration of inflation and taxes. The Fisher equation is used to calculate the nominal rate of interest, while the formula for the after-tax real rate of interest adjusts for taxes and inflation.

Determining After-Tax Real Rate of Interest

Incorporating Tax Rates

When calculating the after-tax real rate of interest, it is important to incorporate tax rates. Taxes can significantly reduce the overall return on an investment. Therefore, it is essential to take into account the taxes that will be paid on the investment returns.

To incorporate tax rates, investors should calculate their after-tax return. This can be done by subtracting the tax rate from the nominal rate of return. For example, if an investor has a nominal rate of return of 10% and a tax rate of 25%, their after-tax return would be 7.5%.

Real Rate of Return Formula

The real rate of return formula is used to calculate the after-tax real rate of return. The formula is as follows:

After-tax real rate of return = [(1 + After-tax return) / (1 + Inflation rate)] - 1

To use this formula, investors need to know their after-tax return and the inflation rate. The after-tax return is calculated by subtracting the tax rate from the nominal rate of return. The inflation rate can be obtained from government agencies or financial news sources.

Once investors have these two pieces of information, they can calculate the after-tax real rate of return using the formula. For example, if an investor has an after-tax return of 7.5% and an inflation rate of 2.5%, their after-tax real rate of return would be 4.87%.

Investors should use the after-tax real rate of return to evaluate their investment options. This rate provides a more accurate picture of the return on investment after accounting for taxes and inflation.

Practical Application

Case Study Examples

To better understand how to calculate the after-tax real rate of return, let's look at some case study examples.

Case Study 1: John invested $10,000 in a mutual fund with a nominal interest rate of 8% per year. He is in the 25% tax bracket and the inflation rate is 2%. To calculate his after-tax real rate of return, he needs to first calculate his after-tax nominal interest rate. Using the formula from The Tech Edvocate, John's after-tax nominal interest rate would be 6% (8% x (1-0.25)). Then, using the formula from SuperMoney, John's after-tax real rate of return would be 3.88% ((1+0.06)/(1+0.02)-1). This means that John's investment is growing at a rate of 3.88% after adjusting for taxes and inflation.

Case Study 2: Sarah invested $5,000 in a savings account with a nominal interest rate of 4% per year. She is in the 15% tax bracket and the inflation rate is 3%. To calculate her after-tax real rate of return, she needs to first calculate her after-tax nominal interest rate. Using the formula from The Tech Edvocate, Sarah's after-tax nominal interest rate would be 3.4% (4% x (1-0.15)). Then, using the formula from SuperMoney, Sarah's after-tax real rate of return would be 0.36% ((1+0.034)/(1+0.03)-1). This means that Sarah's investment is growing at a rate of 0.36% after adjusting for taxes and inflation.

Calculating with Different Tax Brackets

Calculating the after-tax real rate of return can become more complex when dealing with different tax brackets. The formula for calculating the after-tax real rate of return remains the same, but the after-tax nominal interest rate will vary based on the individual's tax bracket.

For example, if two individuals invest in the same mutual fund with a nominal interest rate of 10%, but one is in the 25% tax bracket and the other is in the 35% tax bracket, their after-tax nominal interest rates will be different. The individual in the 25% tax bracket will have an after-tax nominal interest rate of 7.5% (10% x (1-0.25)), while the individual in the 35% tax bracket will have an after-tax nominal interest rate of 6.5% (10% x (1-0.35)).

It is important to take into account an individual's tax bracket when calculating the after-tax real rate of return, as it can significantly impact the return on investment.

Investment Strategies

Tax-Efficient Investing

One way to increase after-tax real rate of return is to invest in tax-efficient investments. These are investments that generate minimal taxable income, such as municipal bonds, index funds, and tax-managed mutual funds. By minimizing the amount of taxes paid on investment income, investors can keep more of their returns and increase their after-tax real rate of return.

Another tax-efficient strategy is to hold investments for at least a year before selling them. This allows investors to take advantage of the long-term capital gains tax rate, which is typically lower than the short-term capital gains tax rate. By reducing taxes, investors can increase their after-tax real rate of return.

Adjusting Portfolio for Inflation

Inflation can erode the purchasing power of investment returns over time. To combat this, investors can adjust their portfolio for inflation by investing in assets that have historically outpaced inflation, such as stocks, real estate, and commodities.

One way to adjust for inflation is to invest in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS). These securities are designed to keep pace with inflation by adjusting their principal value based on changes in the Consumer Price Index (CPI).

Another strategy is to invest in companies that have a history of raising their dividends at a rate that outpaces inflation. These companies are often referred to as "dividend aristocrats" and can provide a steady stream of income that keeps pace with inflation.

By incorporating tax-efficient investments and adjusting for inflation, investors can increase their after-tax real rate of return and achieve their investment goals.

Frequently Asked Questions

What is the formula for calculating the after-tax rate of return?

The formula for calculating the after-tax rate of return is [(1 + After-tax return) / (1 + Inflation rate)] - 1. This formula takes into account the inflation rate and taxes paid on the investment returns.

How can one determine the real rate of return on an investment after taxes?

To determine the real rate of return on an investment after taxes, subtract the tax rate from 1, then multiply the result by the nominal rate of return. Finally, subtract the inflation rate from the result.

What steps are involved in adjusting the nominal interest rate to reflect after-tax returns?

To adjust the nominal interest rate to reflect after-tax returns, one must first determine the tax rate and inflation rate. Then, use the formula [(1 + Nominal Interest Rate) / (1 - Tax Rate) / (1 + Inflation Rate)] - 1 to calculate the after-tax real rate of return.

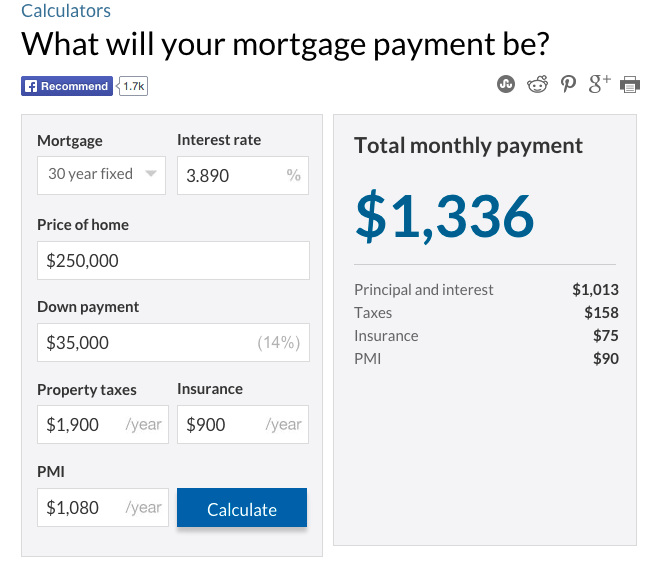

How do you calculate the after-tax return on a mortgage interest payment?

To calculate the after-tax return on a mortgage interest lump sum payment mortgage calculator [infozillon.com], multiply the interest rate by (1 - Tax Rate), then subtract the inflation rate from the result.

What is the process for converting pre-tax rates of return to after-tax figures?

To convert pre-tax rates of return to after-tax figures, one must first determine the tax rate and inflation rate. Then, use the formula [(1 + Pre-tax Rate) / (1 - Tax Rate) / (1 + Inflation Rate)] - 1 to calculate the after-tax real rate of return.

In what way can Excel be used to compute the after-tax real rate of interest?

Excel can be used to compute the after-tax real rate of interest by using the formula =RATE(Periods, Payment, Present Value, Future Value, Type, Guess) and entering the appropriate values for the variables.